How Life Insurance Quote Online can Save You Time, Stress, and Money.

Wiki Article

Some Of Term Life Insurance

Table of Contents4 Simple Techniques For Life Insurance OnlineSome Known Questions About Whole Life Insurance.The Basic Principles Of Child Whole Life Insurance American Income Life Things To Know Before You Get ThisLife Insurance Online Fundamentals Explained

19. 1 Definitions as well as Kinds Of Insurance Discovering Objectives Know the fundamental types of insurance coverage for individuals. Call and describe the various sort of company insurance. Particular terms are usefully defined first. InsuranceA contract of compensation. is a contract of compensation. It reimburses for losses from defined risks, such as fire, hurricane, as well as quake.is the business or person who promises to reimburse. The insuredThe person or firm insured by a contract of insurance. (often called the ensured) is the one that gets the payment, except in the situation of life insurance policy, where payment goes to the recipient called in the life insurance policy agreement. Senior whole life insurance.

More About Senior Whole Life Insurance

Every state now has an insurance division that manages insurance coverage rates, plan standards, reserves, and also other aspects of the sector. Over the years, these departments have actually come under fire in several states for being inadequate and "slaves" of the market. Moreover, huge insurance companies operate in all states, as well as both they and customers have to emulate fifty various state regulatory systems that offer really different levels of protection.We start with a review of the sorts of insurance, from both a customer as well as a business point of view. Then we take a look at in greater information the three crucial sorts of insurance: home, obligation, and life. Public and also Private Insurance Sometimes a distinction is made in between public as well as exclusive insurance coverage. Public (or social) insurance coverage includes Social Safety and security, Medicare, temporary disability insurance coverage, and so forth, funded via federal government plans.

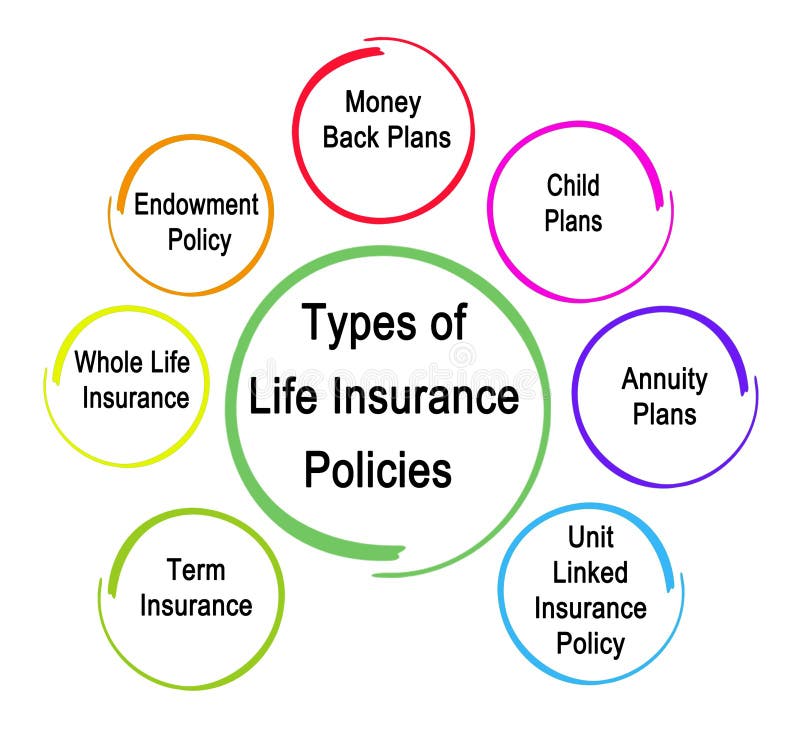

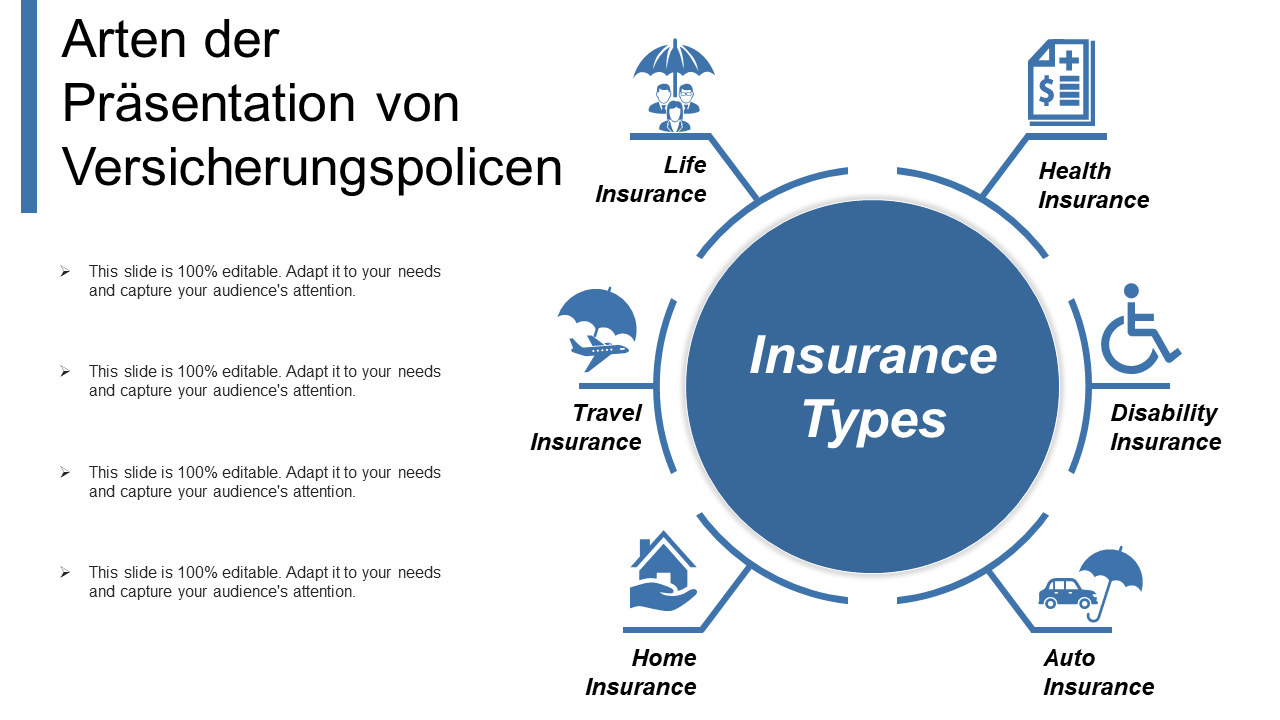

The emphasis of this chapter is private insurance. Kinds of Insurance for the Individual Life Insurance policy Life insurance policy offers your family members or some other called beneficiaries on your death. 2 general types are available: term insurance policyLife insurance policy with a survivor benefit yet no collected cost savings. gives protection just throughout the regard to the plan as well as settles only on the insured's fatality; whole-life insurance policySupplies savings along with insurance policy and can let the insured gather prior to death.

The Basic Principles Of Kentucky Farm Bureau

Medical Insurance Wellness insurance coverage covers the cost of a hospital stay, visits to the doctor's workplace, as well as prescription medicines. Child whole life insurance. One of the most beneficial plans, offered by numerous employers, are those that cover one hundred percent of the prices of being hospitalized and also 80 percent of the fees for medicine as well as a doctor's solutions. Usually, the policy will contain an insurance deductible quantity; the insurance company will not make settlements till after the insurance deductible amount has actually been reached.

Special needs Insurance A handicap policy pays a certain percent of a staff member's earnings (or a repaired amount) weekly or month-to-month if the worker becomes unable to overcome health problem or an accident. Costs are reduced for plans with longer waiting periods prior to payments have to be made: a policy that starts to pay a handicapped worker within thirty days could set you back twice as much as one that delays payment for 6 months.

Get This Report on Life Insurance Quote Online

Automobile Insurance coverage Vehicle insurance policy is perhaps the most commonly held type of insurance policy - Term life insurance. Vehicle plans are needed in at see page the very least minimal quantities in all states. The typical vehicle policy covers liability for physical injury and also residential property damage, medical repayments, damage to or loss of the vehicle itself, and also lawyers' costs in case of a legal action.A personal liability policy covers many kinds of these threats as well as can give protection over of that given by homeowner's and auto insurance policy. Such umbrella protection is generally fairly inexpensive, probably $250 a year for $1 million in liability. Kinds Of Business Insurance Policy Employees' Compensation Almost every company in every state have to guarantee versus injury to workers on the job.

4 Easy Facts About Whole Life Insurance Louisville Shown

Malpractice Insurance Professionals such as doctors, legal representatives, as well as accounting professionals will certainly often purchase malpractice insurance to safeguard against claims made by unhappy clients or clients. For physicians, the cost of such insurance policy has been increasing over the past thirty years, largely due to larger court honors against physicians that are irresponsible in the method of their profession.Obligation Insurance coverage Companies encounter a host of dangers that might result in significant responsibilities. Lots of kinds of policies are available, consisting of policies for owners, proprietors, as well as occupants (covering liability sustained on the facilities); for producers and service providers (for obligation incurred on all facilities); for a company's items and also finished operations (for liability that arises from guarantees on items or injuries triggered by items); for owners and service providers (protective liability for problems triggered by independent service providers engaged by the insured); and also for contractual responsibility (for failure to follow performances needed by specific contracts) (Life insurance).

Today, the majority of insurance policy is available on a plan basis, through single plans that cover one of the most important dangers. These are frequently called multiperil plans. Trick Takeaway Although insurance is a requirement for every US service, and numerous services operate in all fifty states, guideline of insurance policy has actually remained at the state degree.

Report this wiki page